What is a reserve study?

A reserve study report is a budget planning tool for community associations or special use properties. Reserves focus on the long term planning part of the budget of assets that last more than one year and have a repeating life cycle. A reserve study predicts an asset’s remaining life, life when new, and estimated replacement cost of the asset.

Essentially, it’s a road map for the community to have an idea of what capital items to replace, when to replace them, an estimate of how much the replacement will cost, and how much annual funding to set aside each year over 30 years.

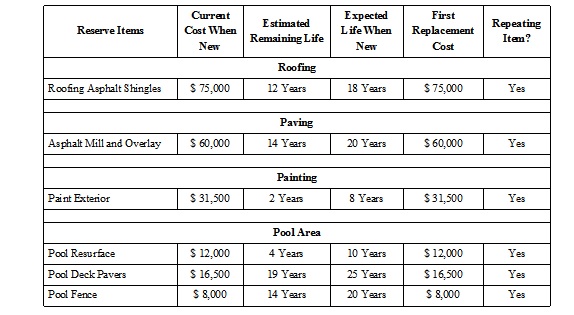

Every community has to submit a reserve schedule to the state of Florida that list their reserve assets. This is what a simple reserve item listing looks like:

How does it help our association or property?

A reserve study is useful in several ways:

- Helps prepare the budget with proper numbers and minimizes guesswork

- Ensures the proper funding is available to make repairs and replacements, which maintain a positive image of your community and keep property values up

- Keeps your association running smoothly and plans a path forward

- Helps eliminate or minimize special assessments

- It’s unbiased and objective and puts the board of directors, homeowners, and property managers on the same page

Why should we fund reserves as opposed to issuing special assessments?

Funding reserves is much more fair than issuing special assessments. Fully funding reserves annually is essentially paying your fair share one small amount at a time. Issuing special assessments is the opposite–one lump sum out of the blue.

Here’s an example. Let’s say a roof will last 20 years and the condominium community is 18 years old, so it has 2 years left before it has to be replaced. Also, let’s say that the community never funded reserves. If Fred lived in the community for those 18 years and then sold his house to Bill, Fred got 18 free years of roofing! Conversely, if the roof was replaced 2 years later, Bill had to pay for 20 years of the roof, but only got to use it for 2 years.

Do I have to have a reserve study in Florida?

It depends on the type of association and whether or not is has vertical construction. For residential condominiums and cooperatives that have buildings that are 3 or more stories, the answer is yes. These associations are subject to structural integrity reserve studies. This was a rule change that passed in 2022 and was modified and updated in 2023.

For condominiums and cooperatives that are less than 3 stories, they do not have to a reserve study. Additionally, there is no rule for HOAs or CDDs that makes it mandatory to have a reserve study.

All associations have to submit a fully funded budget with a reserve schedule. They can then vote to fully fund reserves, partially fund them, or waive their funding altogether. Associations that are subject to structural integrity reserve studies cannot waive reserves for the structural reserve items.

CDDs do not have any formal rules regarding reserves.

What types of properties do you perform reserve studies for?

We produce comprehensive reserve studies for all types of community associations and special use facilities, which include homeowners associations (HOAs), Community Development Districts (CDDs), condominiums, co-operatives, commercial buildings, apartment complexes, churches, office buildings as well as other properties.

Why choose Florida Reserve Study and Appraisal?

All of our reports adhere to and surpass the Community Associations Institute (CAI) national reserve study standards. All properties are inspected by a Florida State Certified General Real Estate Appraiser, a Florida State Certified General Contractor and a CAI designated Reserve Specialist (RS).

Our user-friendly reserve study report includes narrative, photographs, pooled method cash flow plan, component method plan (if applicable), reserve item component cost, remaining life, and useful life inventory. It also includes percent funded analysis, which compares what you have in reserve funds to what the ideal amount should be.

We constantly interact with other communities, boards, and community networks. We have the experience, knowledge, and have seen best practices from other communities. We are uniquely qualified to analyze your association’s reserves and provide you with the proper amount of funding to minimize the possibility of special assessments and yet have adequate funding for future expenses.

Please do not hesitate to contact us; there is no association too big or small for us to help.