What is an insurance appraisal?

An insurance appraisal is a report that estimates the replacement cost of the buildings and improvements of the community association or specific property. An insurance appraisal will have line items for every building and insurable improvement.

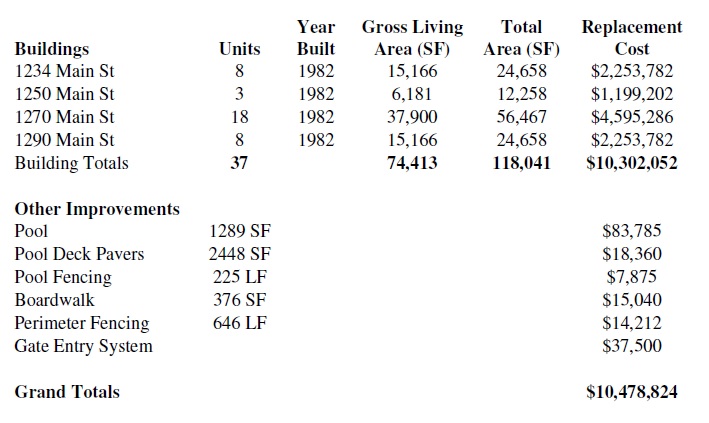

Essentially, it’s a detailed summary of the community’s assets that can be presented to insurance carriers to obtain property insurance. This is what a sample insurance appraisal summary page looks like:

How does it help our association or property?

An insurance appraisal is useful in several ways:

- Helps the association protect their assets in case of a tornado, hurricane, or flood.

- Minimizes risk

- An independent insurance appraisal will be unbiased and have a professional licensed appraiser review its assets.

- It can potentially save your association money from over-insuring its assets or prevent the association from being under-insured after a natural disaster.

- In the case of condominiums, it achieves compliance. It is required every 36 months under Florida Statutes 718.111(11)a.

Do I have to have an insurance appraisal in Florida?

For condominiums, the answer is yes. It is required every 36 months from an independent insurance appraisal. Florida Statutes 718.111(11)a states:

“Adequate property insurance, regardless of any requirement in the declaration of condominium for coverage by the association for full insurable value, replacement cost, or similar coverage, must be based on the replacement cost of the property to be insured as determined by an independent insurance appraisal or update of a prior appraisal. The replacement cost must be determined at least once every 36 months.”

For all other associations and special use properties, the answer is no. However, any good property management strategy would manage risk by insuring your commonly owned property. Furthermore, the board could be liable if they failed to insure commonly owned property and suffered a loss. Typically, HOA townhome communities and multi-family building cooperatives still get an insurance appraisal about every 3 years.

What is covered by hazard insurance?

Most insurance appraisals are for the purpose of obtaining hazard insurance, which covers the property, should something like a fire, hurricane, or tornado occur. Hazard insurance appraisals develop the replacement cost new of the improvements for the property and then subtract out the building components that are not covered by the policy.

The association’s hazard insurance covers the structural components of the building and a few other items including plumbing, electrical, and HVAC rough-ins, sheet rock, interior doors and baseboards. Essentially, the coverage is the building shell without interior finishes.

Hazard insurance for associations typically excludes floor, wall, and ceiling coverings, electrical fixtures, appliances, water heaters, water filters, built-in cabinets and countertops, and window treatments, including curtains, drapes, blinds, hardware, and similar window treatment components.

Additionally, the individual unit owner may purchase an HO6 insurance policy for interior items not covered by the association’s policy.

What is covered by flood insurance?

Properties that reside in a high risk flood zone may also need flood insurance in addition to hazard insurance. Our flood insurance appraisals adhere to the National Flood Insurance Program (NFIP). Flood insurance covers more items than hazard insurance, particularly things inside an individual condominium unit, such as:

- All floor finishes, such as carpet, tile, vinyl, or wood.

- All ceiling finishes such as paint or sprayed finishes

- All wall finishes such as paint, wallpaper, or ceramic tile

- All electrical fixtures, appliances, air conditioners, cabinets, counters, and showers

- All foundations, excavation, pumps, piping below ground and site work

- All awnings or canopies

What types of properties do you perform insurance appraisals for?

We provide detailed insurance appraisals for all types of multi-family, commercial, and industrial properties. Our insurance appraisals serve condominium associations, homeowners associations, community development districts, apartment complexes, cooperatives, insurance agents, business owners, and corporations throughout the state of Florida.

Why choose Florida Reserve Study and Appraisal?

All of our reports adhere to and surpass the Uniform Standards of Professional Appraisal Practice (USPAP). All properties are inspected by a Florida State Certified General Real Estate Appraiser and a Florida State Certified General Contractor. Our reports are accurate and specifically delineate included and non-included costs as they pertain to the specific type of insurance coverage.

We constantly interact with other communities, boards, and insurance agents. We have the experience, knowledge, and have seen best practices from other communities. We are uniquely qualified to analyze your association’s insurance replacement costs.

An accurate insurance appraisal can save your association or property thousands of dollars in premiums. Many properties are over insured based upon market value and not the replacement cost. Under insuring can also be devastating should a loss occur.

Please do not hesitate to contact us; we would love to hear from you.